The Banks have appealed to financial regulators to set a deadline on mis sold PPI payments, the BBA have requested a cut of date of Summer 2014 for PPI claims in a letter to the FSA.]]>

The Banks have appealed to financial regulators to set a deadline on mis sold PPI payments, the BBA have requested a cut of date of Summer 2014 for PPI claims in a letter to the FSA.]]> The Banks have appealed to financial regulators to set a deadline on mis sold PPI payments, the British Bankers’ Association (BBA) have requested a cut of date of Summer 2014 for PPI claims in a letter to the Financial Services Authority (FSA).

The Banks have appealed to financial regulators to set a deadline on mis sold PPI payments, the British Bankers’ Association (BBA) have requested a cut of date of Summer 2014 for PPI claims in a letter to the Financial Services Authority (FSA).If the request is granted and banks are allowed a deadline then it means many people who have not had the chance to reclaim their mis sold PPI will never get this money back.

In a compromise the BBA has stated that the banks will support and finance an awareness campaign through advertising to make customers aware of the end date to re claim PPI.

So far the FSA have not made a decision as to whether the request to set a deadline will be granted.

Deadline for PPI Claims

If a deadline is set for PPI claims then many people may miss out on the money they are entitled to. It is very clear that many people that have been mis sold PPI are not even aware that they are entitled to claim or are worried about claiming.

The banks state that if this goes ahead they will manage and fund an advertising campaign, however, only a few banks have written to customers to let them know they can claim back PPI so are these just empty promises. Can we be sure the investment from the banks will be significant enough to get the information across to all customers who are entitled to claim PPI.

If you look at our PPI infographic you will see that there are still many people who have not claimed back PPI and billions left to be claimed.

The FSA rules say customers should have three years to claim PPI payments from when they find out they are entitled to a claim. However many consumers have still not been notified by banks or financial bodies that they could claim therefore a deadline of only 18 months is going against this legislation.

An FSA spokesman says: “As you would expect for an issue of this scale and complexity, we have considered a number of options and continue to do so.”

We will update you as soon as we know what the FSA decide but it means more than ever you need to make a claim for your mis sold PPI.

Banks are still putting pressure on their staff to sell financial products meaning they are pushing sales over service and many products are being mis sold like PPI.]]>

Banks are still putting pressure on their staff to sell financial products meaning they are pushing sales over service and many products are being mis sold like PPI.]]>

Even though the biggest banks and financial institutions have had a very public and financial slap on the wrist for mis selling PPI, they have not learned from their mistakes and are still mis selling financial products such as insurance, loans and credit cards.

Banks and lenders are still putting undue pressure on their staff and sales people to sell financial products meaning they are pushing sales over service and many products are being mis sold yet again.

Mis sold PPI

Mis sold PPI caused a national scandal as many banks and financial lenders were caught out mis selling Payment Protection Insurance. This was because PPI earned sales people a lot of commission and many employees were put under pressure to meet PPI targets. Like any insurance policy, if information is invalid, incorrect or you are not entitled to a claim then you could be paying into a PPI policy that would never pay out even if the worst happened and one of the situations PPI should cover you for happened.

Sales people and employees selling financial products such as PPI have to follow certain protocols before they can find out if you are eligible. If they do not adhere to this line of questioning and give you the full information then they are not putting your needs before the sale.

Banks should put customer first

To avoid another mis selling scandal like recent PPI claims, banks should start to put the customer first and instead of focussing on sales work out which products the customer needs rather than which product will earn the bank the most money and the sales person the most commission.

Unlike 10 years ago banks are now under much more public scrutiny and if nothing else the PPI court ruling has shown that banks can be made accountable as customers are entitled to claim mis sold PPI.

If banks cannot change the way they do business they may find themselves in a similar ruling over mis sold loans or other types of insurance as customers have more power and are better supported by the ombudsman and FSA.

Let mis sold PPI act as a warning to banks that customer service should always come before a sale.

]]> Reputable PPI Claims companies are being tarnished by the less ethical methods other claims companies are using to win business.]]>

Reputable PPI Claims companies are being tarnished by the less ethical methods other claims companies are using to win business.]]>

Reputable PPI Claims companies are being tarnished by the less ethical methods other claims companies are using to win business.

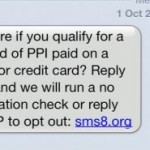

In light of a recent undercover operation, which revealed an overseas business man was making millions off UK residents with spam text messages about PPI, is it time we looked at the way Claims companies treat people?

PPI Claims Companies

Canary Claims do not use spam text messages and only react to genuine claims resulting in happy customers. But this use of spam techniques does tarnish more reputable PPI Claims Companies with the same brush.

PPI Claims companies in the UK know that millions of people all over the UK are actually entitled to claim back mis sold PPI, however this is no reason to bombard every person in the UK with a hard sell similar to that of the banks and lenders who mis sold the PPI in the first instance.

In any industry you will get good and bad companies and unfortunately PPI claims companies have received some criticism over the past few years due to unethical techniques. However, using a claims company can increase your chances of reclaiming the full amount plus interest and takes a lot of the stress and pressure off making a complaint.

Good PPI Companies

There are a lot of very good PPI claims companies and at Canary Claims we pride ourselves on having reclaimed millions for our happy customers. We only take on your claim if we feel we can win it and have a no win, no fee, policy with no hidden charges.

Have you received a text message about PPI?

If you have received an unauthorised text message about PPI (by unauthorised you have not given your number to a PPI company to enquire) then do not text back, just delete the text message and ignore. By responding to these text messages some unethical companies are then selling your numbers to less reputable PPI claims companies.

This practice is actually illegal but the companies that text out and sell your phone number are based overseas so at the moment they cannot be held accountable.

]]> Banks and lenders have lost a case against mis sold PPI after a huge investigation and now all their customers can reclaim PPI if they still have it on a credit policy or have had one over the last ten [...]]]>

Banks and lenders have lost a case against mis sold PPI after a huge investigation and now all their customers can reclaim PPI if they still have it on a credit policy or have had one over the last ten [...]]]>

Banks and lenders have lost a case against mis sold PPI after a huge investigation and now all their customers can reclaim PPI if they still have it on a credit policy or have had one over the last ten years.

PPI

PPI is known as payment protection insurance and may be familiar to you should you have ever taken on a credit policy such as a loan, mortgage or credit card as such. This type of insurance was sold to protect all your payments if you were ever involved in an accident or taken poorly, causing you difficulty in making your repayments. After these investigations, it has now come about that PPI was actually mis sold due to many people were unable to claim when needed. Also it has been sold to jobless customers, self employed and people aged over 65 who would never be able to claim on the payment protection policy. Other customers have been mis sold this product due to bad explanation by the lenders about the PPI product and some customers felt it was a compulsory insurance to take and others felt pressurised into taking on the payment protection. Now thousands of customers have received a refund through reclaiming PPI. The banks and lenders have set billions of pounds aside just to compensate all their customers.

Complaints to reclaim PPI are rising by the day with some banks and lenders receiving up to 400 complaints due to more and more customers are becoming aware that they have also been a victim of payment protection mis selling and now want to also, like thousands of others already have reclaim PPI.

So if you have ever taken on a loan or credit agreement as such over the last ten years, whether you have paid this agreement off in full or still making up your repayments and you think you may have been mis sold payment protection whether you have thought you have been misinformed regarding PPI not knowing the full facts or felt that the insurance was not at all necessary, the you have a strong case to reclaim PPI. With the average claim over two thousand pounds, you have nothing to lose but a lot to gain.

]]> PPI is otherwise known as payment protection insurance and has been mis sold to customers who have applied for a credit card, mortgage or loan agreement to protect their payments]]>

PPI is otherwise known as payment protection insurance and has been mis sold to customers who have applied for a credit card, mortgage or loan agreement to protect their payments]]>

PPI is otherwise known as payment protection insurance and has been mis sold to customers who have applied for a credit card, mortgage or loan agreement to protect their payments should they ever become unemployed, be involved in an accident or become too poorly to work and make repayments to their credit policy. Although this sounds like the most secure thing to do, it has in fact been mis sold to many customers who will never need nor be able to make a claim on it. The banks and lenders worked on a commission basis so the more PPI policies they sold, the better for them.

Mis sold PPI

PPI has been mis sold through a number of ways for example customers have felt pushed into taking on payment protection insurance without knowing the ins and outs of what’s involved. Others have felt they didn’t have a choice and others have found that they have had PPI put on to their loan agreement without their consent. Certain people would never be able to make a claim if they needed too such as the unemployed, self employed and over aged and even these have been wrongly sold PPI.

But however wrong this all sounds, there is some good news. Yes, you can now reclaim your PPI! You can do this due to the banks and lenders losing a huge court case against mis sold PPI and now have to compensate all their customers however they have been mis sold their payment protection in the past ten years. You can reclaim your PPI if you are still making repayments to your credit policy or have paid it off in full and if you have more than one loan agreement, that doesn’t matter as you can still reclaim your PPI.

According to the financial ombudsmen, payment protection insurance is now the most complained about financial product which has already reached 500,000 complaints. These complaints are not slowing down after more customers are realising they too have been mis sold payment protection, so if you think you may be a victim, now is the time to reclaim your PPI.

]]> To reclaim PPI has never been easier, the banks and lenders have put a suffice amount of money to ensure all customers are compensated for their mis sold payment protection insurance.]]>

To reclaim PPI has never been easier, the banks and lenders have put a suffice amount of money to ensure all customers are compensated for their mis sold payment protection insurance.]]>

To reclaim PPI, it couldn’t be easier after our banks and lenders are taking full responsibility for mis selling us the PPI in the first instance after losing a court case against them. PPI is otherwise known as payment protection insurance and has been offered to people taking out either a loan, credit card or mortgage to protect payments should the policy holder ever become unemployed, poorly or be involved in an accident causing them difficulty in making repayments. This payment protection is only available to specific criteria and people who are a certain age, jobless or self employed although PPI has been mis sold to these people and some people who do fit under this criteria have been unable to reclaim PPI.

Can you Claim Back PPI?

This is not the only example of PPI mis selling though and if you have ever been for a loan or credit agreement, you need to check whether you have payment protection on your policy or not as many people don’t even know they have it meaning they have been paying out for something they neither want or need to use paying out money and interest. If this is the case, then you too can reclaim PPI. Many people have been aware that they have payment protection on top of a loan agreement but have felt at the time of taking this on that they were persuaded into it without knowing much information about how payment protection works. Also many have felt that PPI was a compulsory product to take.

To reclaim PPI has never been easier, the banks and lenders have put a suffice amount of money to ensure all customers are compensated for their mis sold payment protection insurance. Even after underestimating the amount required to do so, some banks have now had to put even more money aside and with more and more complaints to reclaim PPI it’s a good job, so all customers receive their specific amount owed.

Since the insurance complaints started in early 2011, two billion pounds has already been distributed between customers who have reclaimed PPI. If you think you have been a victim of payment protection insurance mis selling then you need to take action and reclaim PPI today.

]]> If you think you too may have been a victim of mis sold PPI, then you need to take action as soon as possible to ensure you too get the compensation you deserve.]]>

If you think you too may have been a victim of mis sold PPI, then you need to take action as soon as possible to ensure you too get the compensation you deserve.]]> The PPI scandal has actually been unravelled over the last three decades by being accused of people being offered an unnecessary and expensive product from the early nighties. In November 2005, PPI was questioned about poor selling procedures by specific banks and lenders to their customers. Over the years there has been a full investigation regarding PPI and now due to what the investigation has found the banks and lenders have lost a case against mis selling the PPI product.

The PPI scandal has actually been unravelled over the last three decades by being accused of people being offered an unnecessary and expensive product from the early nighties. In November 2005, PPI was questioned about poor selling procedures by specific banks and lenders to their customers. Over the years there has been a full investigation regarding PPI and now due to what the investigation has found the banks and lenders have lost a case against mis selling the PPI product.

Payment Protection Insurance – PPI

PPI (Payment Protection Insurance) may have some familiarity to you should you have ever taken on a loan, mortgage, credit card or any such credit agreement. It stands for payment protection insurance which was sold to protect your payments should you become poorly or be involved in an accident or unemployment. This to some people was a necessary product to take, ensuring that if any of this were to happen, they knew their credit repayments were being paid. But to others this was not the case. It has come about during many investigations that in fact the PPI product had indeed been mis sold.

Many cases have shown that people did not even know they had such product and have been paying an expensive policy on top of their loan amount for something they do not require or use. Others have felt pushed into taking on PPI and others have felt that they did not have a choice and didn’t know that the payment protection insurance was not compulsory. Also PPI has been should to people who would never be legible to make a claim on it due to them being either jobless, self employed or over the age limit of making the claim. But now because of this the customers can now claim it all back plus interest in some cases.

The banks have already received a vast amount of complaints and receiving more and more by the day due to many people finding out that they too have been a victim of mis sold protection insurance. Complaints have risen by 59% meaning the banks and lenders now have to put even more money aside to compensate their customers after underestimating the overall refunding amount required.

If you think you too may have been a victim of mis sold PPI, then you need to take action as soon as possible to ensure you too get the compensation you deserve.

]]>

The average PPI payout is £2750 so if you have a credit policy or loan, its worth taking a look to see if you are a victim of mis sold PPI and make a PPI claim.]]>

The average PPI payout is £2750 so if you have a credit policy or loan, its worth taking a look to see if you are a victim of mis sold PPI and make a PPI claim.]]>

You will have more than likely heard of PPI recently either over the radio or on the television. Whether you have or not, it could be of some interest to you. PPI stands for payment protection insurance and is sold to you when applying for some sort of credit agreement such as a credit card, loan or mortgage or even something small like a store card as such. This insurance is there to protect your payments should you ever become poorly or unemployed but it has no come about that this payment protection was actually mis sold to the customers of the banks and lenders and PPI is now the most complained about product the ombudsmen has ever seen.

PPI Claims

PPI has been mis sold in a number of ways to customers either through pressurising, a non explanation of the product, sold to customers under false pretences and sold to people who would have no chance of being able to claim. The banks are up to 500,000 complaints so far with no sign of slowing down. They honestly didn’t estimate this amount of PPI complaints and have now had to put more money aside to compensate their customers.

The average PPI payout is £2750 so if you have a credit policy or loan, its worth taking a look to see if you are a victim of mis sold PPI. You can make a PPI claim in most cases if you are either still making repayments to a loan agreement or have paid of the agreement in full over the last ten years. It should tell you on a statement whether you have the payment protection of not. If you can’t find it then its worth contacting your loan provider who will inform you if you have it or not.

Making a PPI claim is quite simple to do in which banks are being urged to sort out these complaints as quickly and fairly so people do not have to wait longer for justice. Banks and money lenders do receive day to day complaints but have risen a mighty 59 percent in the first half year, mainly through PPI.

]]> Banks and lenders have already paid out two billion pounds in PPI compensation and this is raising by the day as more and more victims are making a PPI Claim]]>

Banks and lenders have already paid out two billion pounds in PPI compensation and this is raising by the day as more and more victims are making a PPI Claim]]>

Banks and lenders have already paid out two billion pounds in PPI compensation and this is raising by the day as more and more people are realising they are victims and making a complaint about mis sold payment protection insurance (PPI). The financial services authority have implemented and ensuring the victims of mis sold PPI are fully compensated ensuring that the banks and lenders are making PPI compensations quickly and professionally to make sure all customers are given the justice they deserve.

PPI Compensation Claim

If you have taken a loan or credit agreement over the last ten years whether paid off in full or still making repayments then you too could be entitled to some PPI compensation.

To make a PPI compensation claim is easy to do and you will get full support from the FSA. Before you take the first step in making a claim, you need to be prepared to make your case clear so you can prove you are a victim of payment protection insurance. If you are unsure whether you have payment protection or not then you can simply look on a statement where it will say or contact your specific credit lender. Then think back to when you took on the loan, was PPI discussed? Did you know exactly what it was and would you be entitled to make a claim should anything happen to you? This meaning that the unemployed, self employed and over a certain age, although sold the protection would never actually be able to claim. Also did you know that PPI wasn’t compulsory? Did you feel pressurised? If any of these are familiar then you have a strong case to get some PPI compensation.

You can make a PPI compensation claim yourself although to take the stress out of the chasing up and paperwork involved, some people have used a claims company to do all that for them. Either way you should receive your full PPI compensation within a number of weeks and with the average payout being over £2000, what are you waiting for? Don’t miss out on PPI compensation; get it whilst it’s there and rightfully yours!

]]> Mis sold PPI is said to be the most complained about financial product according to the financial ombudsmen after a full investigation has been taken out on banks and lenders after selling a product when taking out a loan in [...]]]>

Mis sold PPI is said to be the most complained about financial product according to the financial ombudsmen after a full investigation has been taken out on banks and lenders after selling a product when taking out a loan in [...]]]>

Mis sold PPI is said to be the most complained about financial product according to the financial ombudsmen after a full investigation has been taken out on banks and lenders after selling a product when taking out a loan in which customers will neither use nor need.

Mis Sold PPI

People who have applied for loans, credit cards, store cards or mortgages have found that were paying out an expense just on payment protection insurance and realising they never actually knew they had it amongst other examples of mis sold PPI. In some cases, people have been paying up to 30% of their original loan amount just in PPI and with the average refund of over £2000 there have now been up to 500,000 complaints so far and now the banks are having to set aside even more money just to compensate their mis sold PPI victims.

If you are like many others who in the past have taken out a credit agreement such as a loan, mortgage or credit card as such, you too may be a victim of mis sold PPI so its worth looking into and thinking back to when you took on your policy with your specific bank or lender. Did you know you had payment protection insurance? And if so was it explained to you in full? At the time of taking on your loan, were you eligible for PPI? Did you know it was not compulsory? Did your lender give you much choice about payment protection insurance or did you feel pushed into it? Maybe you felt vulnerable at the time and thought it was the best thing to do even though you didn’t know much about the product? All these are examples of mis sold PPI and now is the time that you can claim it all back whether you are still making repayments or have paid the loan agreement off in full over the last ten years then you can still make a claim against mis sold PPI.

Due to the banks and lenders losing this battle against mis sold PPI, they now have to compensate all their customers in a quick and professional manner to ensure their victims do not have to wait any longer for compensation.

]]>